For many individuals, real estate has always been defined as out of reach, with large upfront expenses, endless paperwork, and years of waiting for returns. Now, new technology is changing that concept. More investors are inquiring about how to tokenize real estate because this process enables anyone to own a portion of a property, not just the entire thing. The old barriers are also coming down fast.

Tokenization means properties can be split into virtual units that anyone can buy, sell, or hold. It is a big change. Suddenly, you do not have to be a millionaire to join the major market. The shift is not just technical; it is a new way of thinking about ownership.

In this blog, you will find how this transformation works, what it means for both buyers and sellers, and why it is opening doors that were once closed.

Before diving into the details, it is worth understanding the heart of this transformation. Tokenization is a simple idea of great impact: Take a property, divide it into many small, digital symbols, and let people buy as much or as little as they want. Each token is stored safely online and represents a proportion in the building, house, or land.

This process is not just about sharing ownership. It removes many old barriers and brings in people who once thought real estate investment was impossible. Now, with the right setup, you can invest in a city farm in the city or a distant holiday home, starting with just a fraction.

People who are curious to know how to tokenize real estate for regular people can get the answer with this approach

This new approach means that someone can ask, “How to tokenize real estate for ordinary people,” and get a real answer. By dividing assets into symbols, investments are easier, safer, and ready for anyone who wants to join the market.

This is what really strengthens tokenization – more than just websites and apps. The process begins with legal experts reviewing the property and confirming that it can be divided into symbols. A reliable third party (often a legal team) writes the ownership rules and ensures that the property is free of disputes or debt.

Next comes the technology. With questions like how to tokenize commercial real estate becoming even more common, teams use secure digital contracts (Smart contracts) to create, track, and trade each token. These contracts are self-executing and live on a blockchain, so every single transaction is locked in and easy to audit.

Once the tokens are ready, they are listed on a marketplace. Investors from all around the world can sell or buy them immediately. Owners can see who holds a token at any time, with no hidden deals. The entire process from legal checks to blockchain trading is the reason behind companies and investors knowing how to tokenize commercial real estate for a broader global audience.

Tokenization is already transforming the landscape in cities all around the world. In New York, luxury apartments are divided into tokens and sold to dozens of small investors. In Singapore, groups use the tokenization to own co-working spaces or invest in high-rise commercial towers.

In Europe and the Middle East, family offices are searching the ways to diversify by buying tokens in faraway real estate arenas.

What is new is not just the technology, but the access it creates. All-from first-time buyers to global companies-can buy a share in a building or house without needing huge amounts of capital. With questions such as how to tokenize residential real estate, growing in popularity, these models are now opening local and international property agreements for everyday people.

This shift makes properties more flexible, boundless, and really open for the first time.

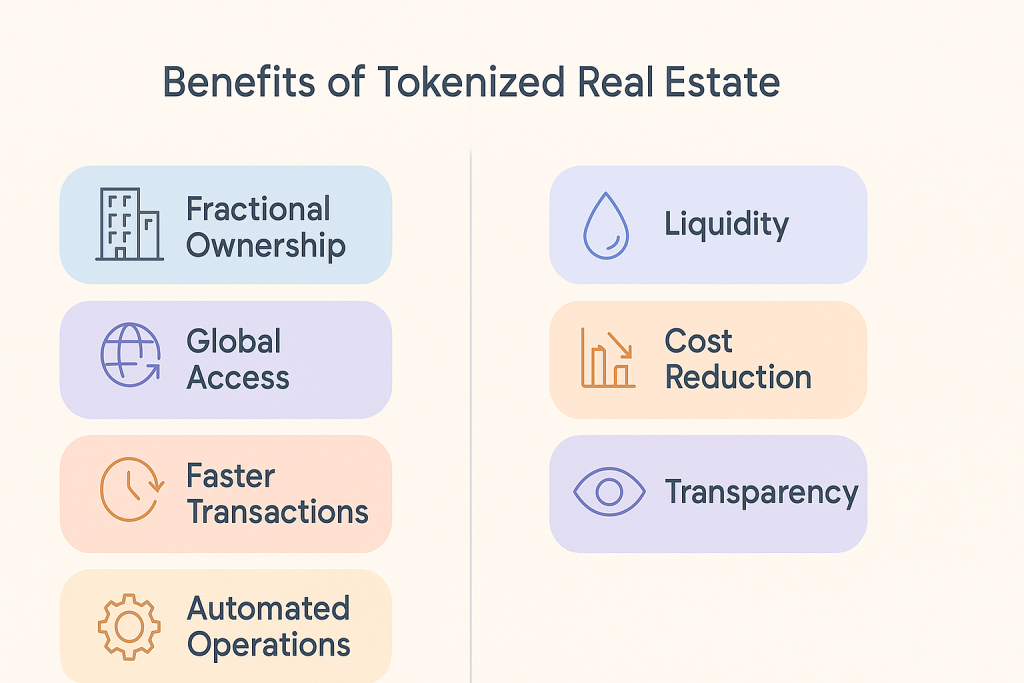

Why all the excitement? Well, tokenization unlocks a lot of perks for investors. Check these:

Unlike traditional agreements or REITs (Real Estate Investment Trusts), owners offer greater control and alternatives. People seek out residential properties now not only for profits, but for simplicity and flexibility.

A good partner handles legal reviews, real estate checks, and ensures that your investment is safe from the start. They help you in setting up smart contracts, listing tokens on trusted marketplaces, and making dashboards to track your shares.

A good partner handles legal reviews, real estate checks, and ensures that your investment is safe from the start. They help you in setting up smart contracts, listing tokens on trusted marketplaces, and making dashboards to track your shares.

If you have just started with digital assets, you do not have to learn it all alone. With the right team behind you, your journey from question ( “how to tokenize real estate?”) to owning tokens is smooth, secure, and rewarding.

Staying on the right side of the law matters the most. Here’s how to do it the right way:

Trying to handle these steps alone is risky. The finest results come from a professional who knows every step, from legal review to secure trading.

In 2025, tokenization is expected to transform how people invest. Several apps are being built for easy trade. Groups of friends or investors (even Daos) will collect money to own buildings together. The markets will be busier, with tokens that are sold as easily as shares or crypto coins.

The old restrictions are fading. Learning now means being ready for a new world of property ownership that is open to everyone.

The door to property possession is finally open wider than ever before. With digital symbols, more people can invest, share profits, and participate in projects that were once out of reach. Technology makes it easier, safer, and more flexible to be part of this market.

If you are searching for ways to build wealth, explore the tools and teams that help answer the frequently asked question – how to tokenize real estate and find out how simple property investment can be in the digital era.