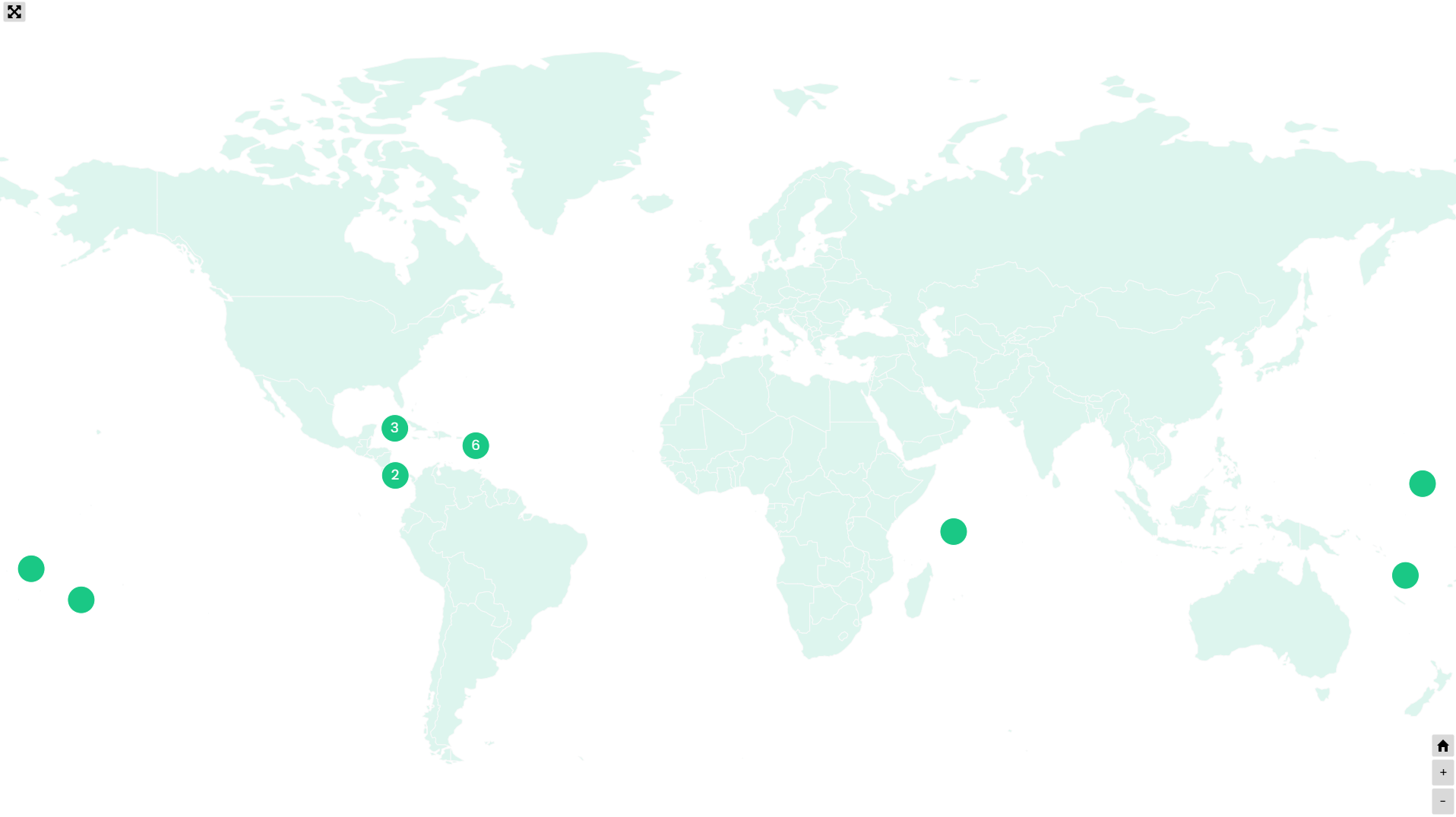

Customized solutions that fit your specific business needs in over many offshore jurisdictions.

Our digital platform makes setting up your offshore company as easy as a few clicks.

From legal advice to corporate structuring, our experts are here to guide you every step of the way.

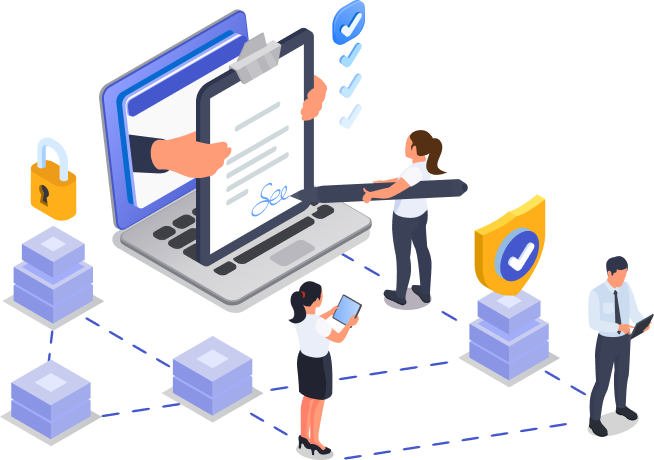

When you register an offshore company, the process should be clear and reliable. Once you select your jurisdiction, we prepare the incorporation documents and file them with the registrar so your new company is legally established and ready for international business.

To register an offshore company, compliance must be completed correctly. Our secure online notarization verifies your passport and proof of address through a high-tech video call. This service is legally recognized in every supported jurisdiction and ensures that your company meets strict KYC standards without delay.

With OVZA, what you see is what you get. Enjoy clear, upfront pricing without hidden fees. Regardless of the bank you select from our network, we guarantee a straightforward flat fee, ensuring your financial planning is never disrupted by unexpected costs.

Leverage OVZA’s deep local expertise in banking regulations and practices. Our experience enhances your preparation for the due diligence process, significantly increasing your chances of swift bank account approval.

The way you register an offshore company has lasting benefits for asset protection and tax efficiency. Supported jurisdictions provide offshore frameworks with no income tax, no capital gains tax, and no withholding tax on foreign income, allowing your company to operate in a favorable environment.

Each time you register an offshore company with us, your documents and data are secured with 256-bit SSL encryption and EV-SSL certification. From submission of your information to final incorporation, every step is safe and aligned with modern standards of compliance and transparency.

| Region | Jurisdictions | Registration Fees (USD) | Annual Fees (USD) |

|---|---|---|---|

| Africa |  Seychelles Seychelles |

595 | 590 |

| The Americas |  Anguilla Anguilla |

1,040 | 1,030 |

| The Americas |  Antigua and Barbuda Antigua and Barbuda |

1,600 | 1,350 |

| The Americas |  Bahamas Bahamas |

1,360 | 1,120 |

| The Americas |  Belize Belize |

990 | 1,190 |

| The Americas |  British Virgin Islands British Virgin Islands |

1,690 | 1,450 |

| The Americas |  Cayman Islands Cayman Islands |

2,900 | 2,610 |

| The Americas |  St. Kitts and Nevis St. Kitts and Nevis |

1,470 | 1,390 |

| The Americas |  St. Lucia St. Lucia |

1,850 | 1,600 |

| The Americas |  St. Vincent and the Grenadines St. Vincent and the Grenadines |

1,110 | 970 |

| The Americas |  Panama Panama |

1,490 | 980 |

| The Americas |  Costa Rica Costa Rica |

1,790 | 1,350 |

| Asia Pacific |  Marshall Islands Marshall Islands |

1,090 | 890 |

| Asia Pacific |  Samoa Samoa |

840 | 755 |

| Asia Pacific |  Vanuatu Vanuatu |

1,400 | 900 |

| Asia Pacific |  Cook Islands Cook Islands |

1,790 | 1,490 |

When you register an offshore company through Chainbull, you gain access to trusted zero-tax jurisdictions with streamlined compliance. Our offshore incorporation solutions cover IBCs, LLCs, and tailored structures, ensuring your business is established quickly and securely. With Chainbull, you not only register your offshore company but also benefit from our expertise in offshore bank account applications, notary services, and full compliance guidance.

Register your offshore company with Chainbull efficiently across multiple jurisdictions. From IBCs to LLCs, our incorporation process is streamlined and cost-effective.

Form your offshore company in internationally recognized, tax-neutral jurisdictions. Benefit from zero corporate tax, no capital gains tax, and complete offshore flexibility.

Once your offshore company is registered, Chainbull supports you with international bank account applications through our trusted banking partners.

Our global notary network can notarize passports and proof of address online for just USD 250, ensuring fast and compliant offshore company formation.

The offshore world is changing, with stricter due diligence requirements. Chainbull keeps you compliant through secure systems, automation, and encrypted onboarding.

Register offshore companies in the world’s leading jurisdictions, with structures that support asset protection, estate planning, and cross-border investments.

Select from 16 offshore jurisdictions tailored to zero-tax business structures, including Seychelles, BVI, Cayman Islands, and more. Chainbull helps you compare the advantages of each jurisdiction so you register the offshore company that fits your goals.

Enter your email → Get instant download.