Real estate has always been ranked as one of the safest and most lucrative paths to wealth creation. However, traditional property investment is usually accompanied by certain obstacles such as high entry costs, limited liquidity, and complicated legal procedures. Over the last few years, blockchain technology has brought in a disruptive paradigm—real estate tokenization—that is transforming the way investors and developers communicate with property assets.

The essence of this futuristic way of doing things has escalated the role of a real estate tokenization development company, which is the link between the traditional property markets and the blockchain-related innovation. By creating platforms to tokenize assets, these companies turn real estate investing into a more inclusive, efficient, and universally accessible one.

Real estate tokenization refers to the method of changing the ownership of property into the form of decode tokens on the blockchain. Every token denotes a percentage of the total property’s value, hence investors are allowed to buy smaller shares rather than a whole asset.

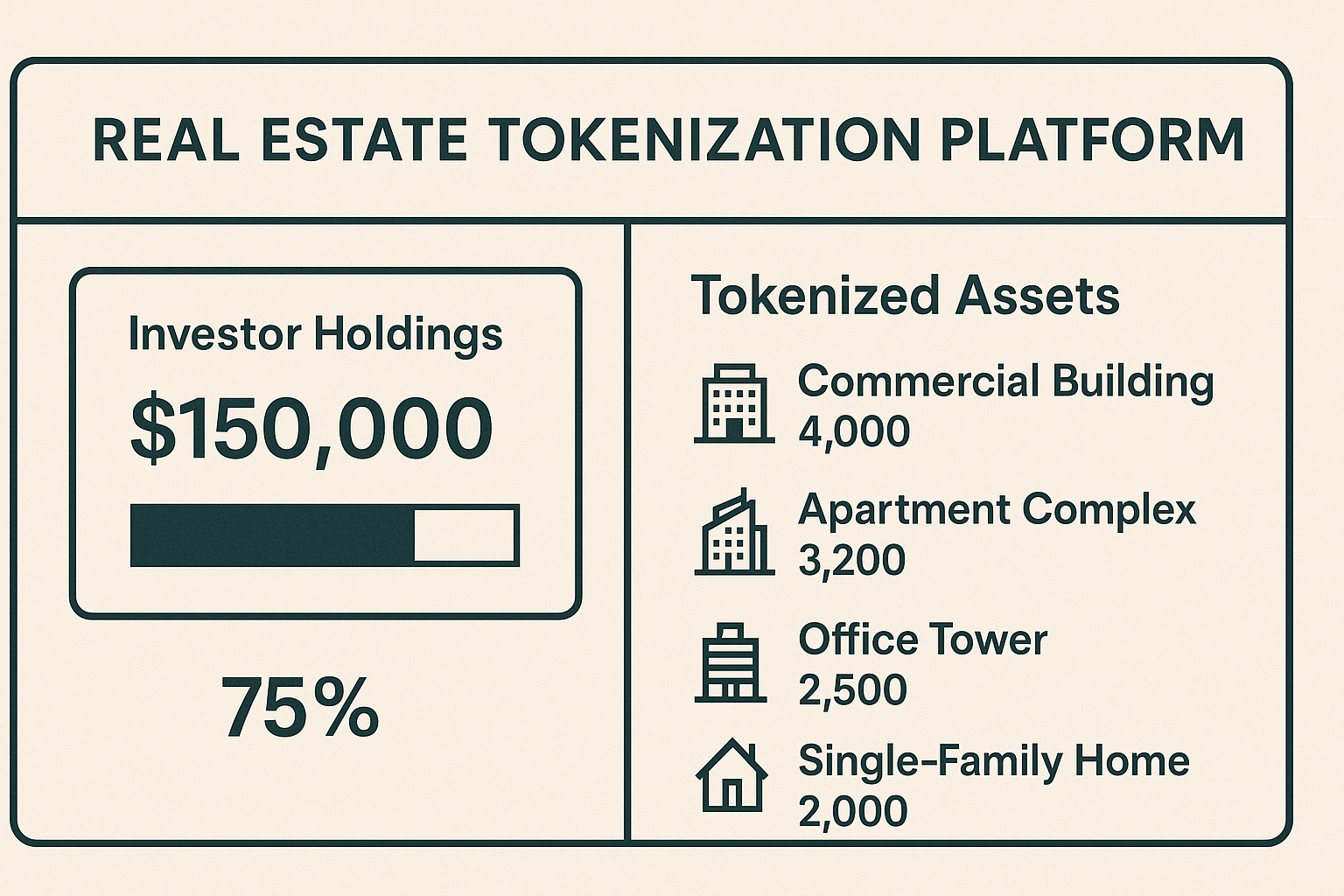

One of the main advantages of tokenization is that it can be very attractive from the point of view of accessibility and flexibility. Instead of the typical requirement of millions to invest in a commercial property, investors can start with much smaller amounts. This fractional ownership paradigm is actually real estate getting more fair, and thus, retail investors from all corners of the earth being endowed with the chances.

Traditional property investment in the market tends to be slow, costly, and closed to most people. Tokenization solves these problems by bringing in the features of the financial world such as liquidity, transparency, and global participation on the real estate market.

Just to illustrate, a $20 million office building can be broken down into 2 million tokens each with a value of $10. The idea makes it possible for thousands of both local and foreign investors to engage in multimillion-dollar projects without the need of large sums of money.

A tokenized real estate development company is essential to conversion in tokenization mode. Those firms offer necessary technical and legal expertise, as well as software for safe handling of the property and its investors

Fundraising for developers is a major problem when it comes to large-scale projects. They usually depend on institutional investors, banks, or private equity, which is not very flexible. By teaming up with a tokenized real estate development company, developers get faster and more diverse funding options.

This approach not only secures faster capital but also builds stronger trust between developers and investors.

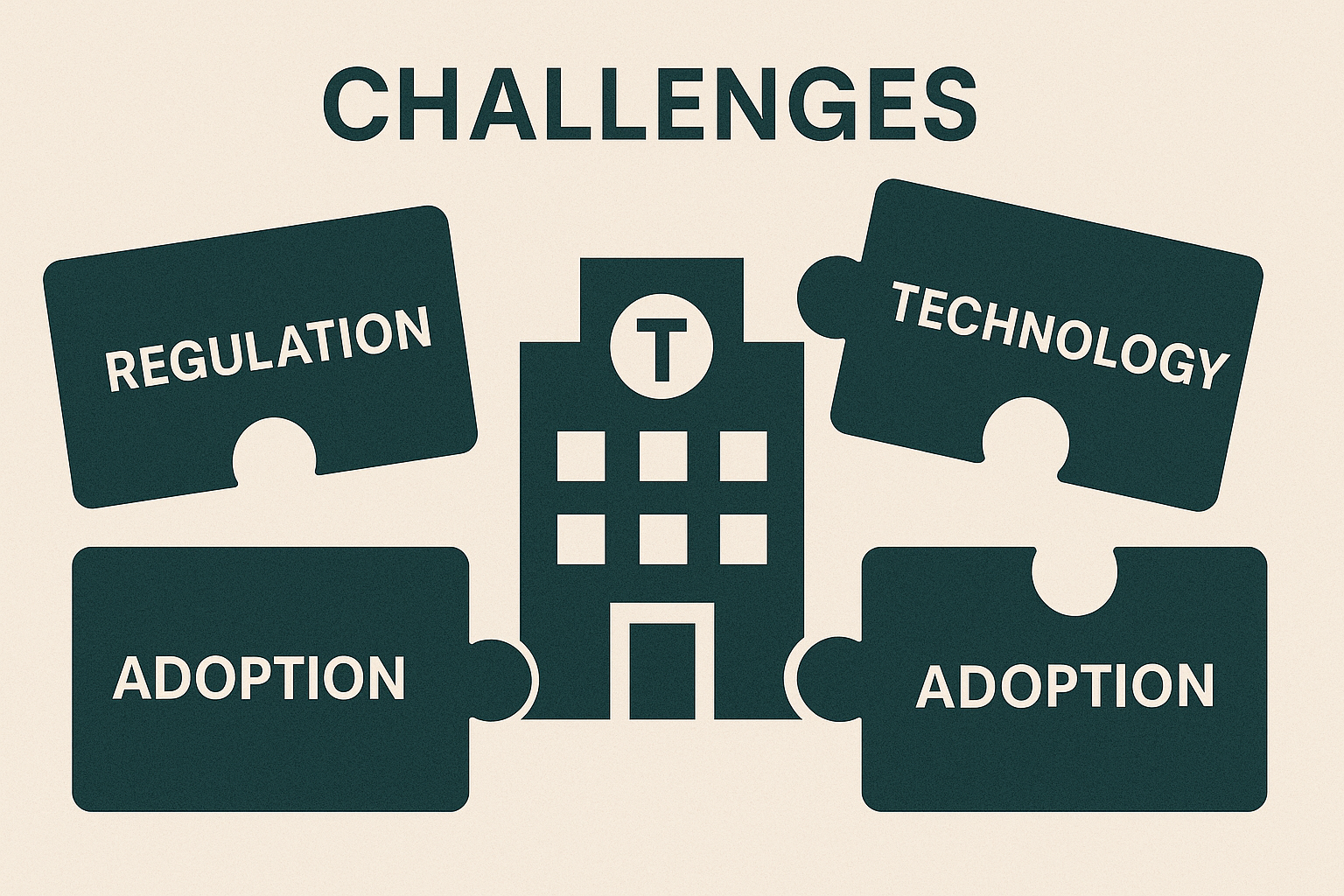

Tokenization in the real estate sector is full of challenges despite its bright potential. A tokenized real estate company with a competent team can definitely overcome problems but we still have to deal with the situation where the obstacles have to be faced before ripening into a common tokenized real estate practice.

The future of tokenization of real estate is optimistic. Analysts forecast that in the next ten years, real estate worth trillions of dollars might be tokenized. With the improvement of regulatory clarity and the rise of investor awareness, tokenization is going to be the most common way of property ownership and fundraising.

Besides that, a real estate tokenization company will be more present on the market, not only as a service provider but also as an ecosystem developer. Those companies will probably:

As adoption speeds up, tokenized real estate has the potential to fundamentally change property markets all over the world, thereby democratizing investment opportunities and allowing them to be borderless.

The rise of real estate tokenization marks a new era for property investment. By enabling fractional ownership, liquidity, and global participation, it makes real estate far more accessible and efficient than traditional models.

Chainbull is the best real estate tokenization company that offers the most secure, scalable, and customized solutions to property developers and investors located anywhere in the world. By marrying cutting-edge blockchain technology with deep real estate market knowledge, we bring about the transformation of global real estate investing into a more transparent, inclusive, and profit-friendly venture.

Enter your email → Get instant download.