Most articles on crypto exchange development stop at surface-level explanations.

This one doesn’t.

If you’re reading this, you already know what a crypto exchange is. The real questions now are:

Why do most exchanges fail after launch?

Where do costs silently explode?

Why liquidity integrations break under real traffic?

Why “white label” exchanges often hit a scalability wall?

What actually differentiates a serious crypto exchange development company from a code vendor?

This guide addresses those exact gaps-based on real-world exchange builds for India, the United States, and global markets.

Forget UI.

Forget token listings.

Your exchange lives or dies by matching engine performance under stress.

Deterministic order matching (price-time priority)

Sub-millisecond latency under burst traffic

Ability to process 10k–100k TPS spikes

Graceful degradation during volatility events

Most off-the-shelf engines fail when:

Market makers pull liquidity

Order cancellations spike 10x

Bots exploit queue latency

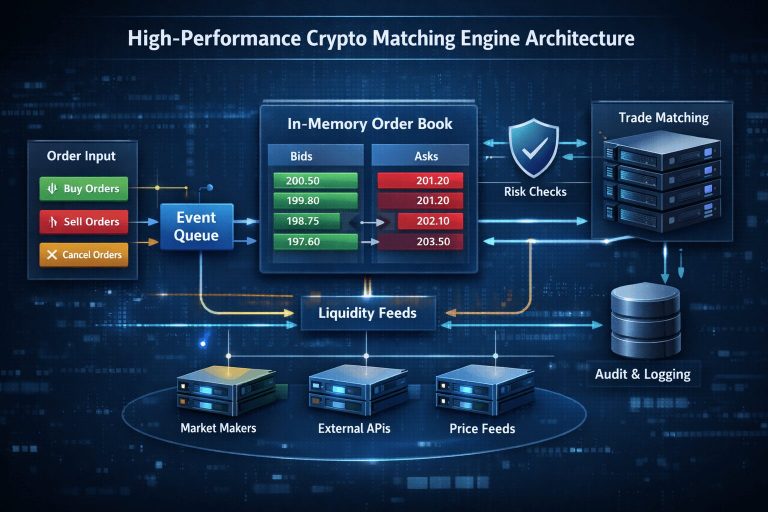

Advanced crypto exchange software development uses:

In-memory order books

Event-driven architectures

Write-ahead logging for recovery

Separate risk engines per trading pair

This is where serious engineering budgets go – and where cheap builds collapse.

Liquidity is often misunderstood as a one-time integration.

It isn’t.

Fake depth from shared LP pools

Arbitrage draining INR/USDT pairs

Latency mismatch between LPs

Slippage during volatile markets

Advanced exchanges:

Combine external LPs + internal market making

Use spread control logic

Implement volatility circuit breakers

Isolate LP failure from retail order flow

Any crypto exchange development company that promises “deep liquidity in 48 hours” without discussing risk offsets and pair-specific behavior is overselling.

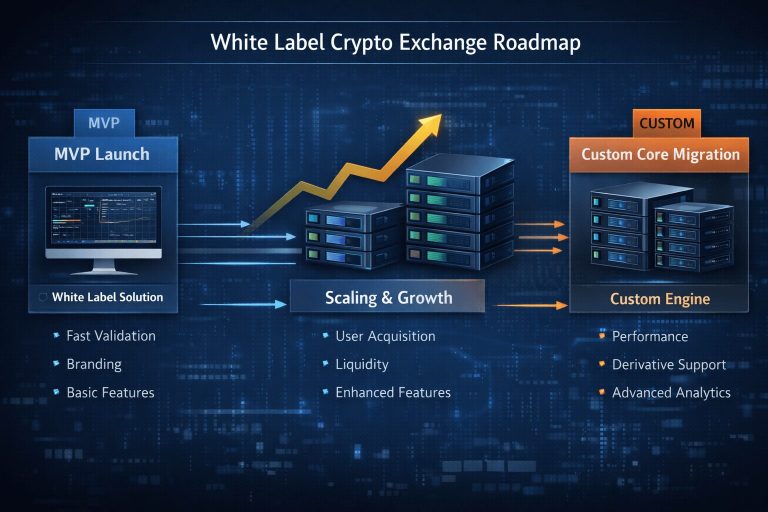

White label is not bad.

Blind white label usage is.

You launch fast to test market demand

You accept architectural constraints

You plan a Phase-2 custom engine

Daily active traders exceed ~8–12k

You introduce derivatives or P2P

You need regulatory-specific flows (US vs India)

You require exchange-level analytics

Smart founders use white label as a launchpad-not a permanent foundation.

Most cost estimates online are misleading because they ignore operational complexity.

Security audits (ongoing, not one-time)

Compliance workflows (manual reviews scale badly)

Liquidity risk buffers

Cloud cost during volatility spikes

Support + fraud response teams

| Component | Cost Range |

|---|---|

| Matching Engine (Custom) | $25k–50k |

| Wallet Infrastructure | $10k–20k |

| White Label Core | $35k–70k |

| Mobile Apps | $15k–30k |

| Security & Audits | $10k–25k |

| Liquidity Setup | $5k–20k |

A production-grade exchange is rarely under $60k–$120k when done correctly.

Compliance is not a checkbox—it’s system design.

KYC workflow branching

Suspicious activity monitoring

Audit logs that regulators can replay

Reference:

FinCEN MSB Requirements

INR rails integration

Transaction-level traceability

FIU reporting structure

Poor compliance design = manual ops = rising costs = stalled growth.

Mobile apps fail when:

Web sockets choke under market spikes

Order states desync

Wallet balances lag

Advanced apps:

Use real-time state reconciliation

Separate trading & wallet APIs

Implement offline-safe order states

Support biometric + hardware-backed security

This is the blueprint experienced founders follow:

Launch with controlled features

Limit pairs initially

Simulate extreme volatility pre-launch

Design for regulatory evolution

Migrate architecture before scaling hurts

Most exchanges don’t fail because of lack of demand.

They fail because the foundation can’t handle success.

Avoid teams that:

Promise “Binance clone in 30 days”

Can’t explain order matching logic

Don’t ask about liquidity strategy

Ignore compliance early

Work with a crypto exchange development company that:

Talks in trade-offs, not promises

Designs for scaling pain

Understands US + India market differences

Thinks like an exchange operator-not an agency

In 2026, building a crypto exchange is no longer a tech challenge-it’s a systems engineering and risk management problem.

The difference between exchanges that survive and those that disappear is not features.

It’s architecture, liquidity control, and execution discipline.

Enter your email → Get instant download.