Tokenization of real estate is moving beyond theory into measurable market adoption. A few years ago, it was just an experimental use of blockchain, but now it is supported by asset values worth billions of dollars, institutional pilots, and regulatory engagement. The data indicates that real estate is becoming one of the quickest sectors in the tokenization of real-world assets.

Local tokenization of real estate projects has recently been reported in the news only, but now the news is different as there are huge offerings of commercial properties, residential portfolios, and development-stage assets in the form of regulated digital tokens. This transition from retail to enterprise-grade adoption is evident in the market.

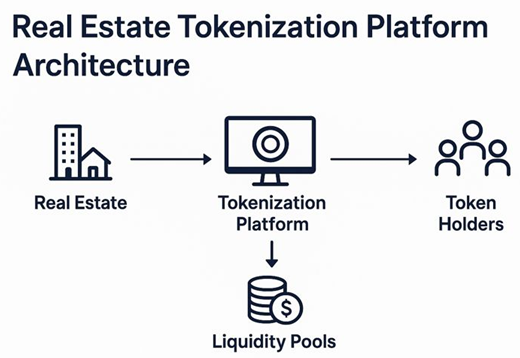

Such a change for blockchain firms means that they need to have advanced development capabilities in real estate tokenization. In order to create a scalable real estate tokenization platform that is efficient and attractive to investors, it is now essential to have a data-driven architecture, regulatory intelligence, and production-level blockchain engineering that is compatible with global capital markets.

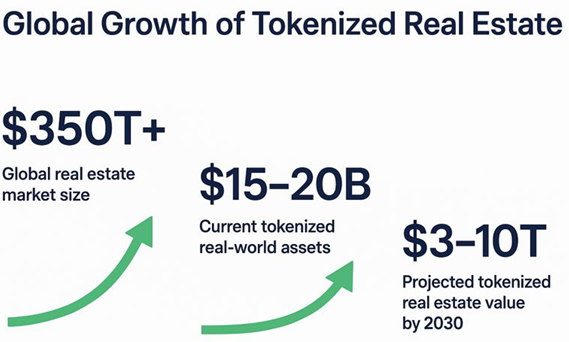

The worldwide real estate market is an eight-figure wonder with the total assets value estimated to be above $350 trillion, hence it is the largest asset class by far. As a result, even a small share of tokenization in this sector would mean a massive opening for blockchain infrastructure providers.

According to the industry data, the real-world asset tokenization on public blockchains is somewhere between $15–20 billion in represented value, out of which real estate is becoming the major contributor quite rapidly. The tokenized real estate assets have demonstrated one of the highest year-to-year growth rates within the RWA category.

The forecast models are showing a possibility that by 2030, tokenized real estate might account for 1-3% of the global property market, which would be equivalent to $3-10 trillion in tokenized value. Just this one projection puts real estate tokenization at the top of blockchain verticals in terms of commercial viability.

Several measurable trends highlight why the tokenization of real estate is accelerating:

These figures reveal that real estate tokenization is not just a theoretical concept but is actually achieving measurable efficiency gains.

A cutting-edge real estate tokenization platform is where finance, law, and blockchain infrastructure come together. Economically, the platform’s effectiveness is mainly dependent on its automation and scalability.

Data from early adopters reveal that platforms for tokenization have the potential to cut down the whole process of capital raising by as much as 50%. What used to take months of paperwork can now be done in a matter of hours or days through compliant digital issuance, which enables investor onboarding and allocation.

Revenue generation mechanisms at the platform level are also scalable. Tokenized structures make it possible for issuers to attract international investors, which therefore leads to the capital inflow pools becoming 3–7 times larger than they were for domestic-only offerings. This is the main reason why real estate tokenization platforms are a great fit for property developers and funds.

Here are the main asset classes that have been the primary source of real estate tokenization:

Residential buildings have been one of the main contributors to tokenized real estate pilot projects. Rental yield tokenization makes monthly or quarterly distributions more efficient by automating them through smart contracts.

Research findings reveal that tokenized residential assets result in higher investor loyalty, as smaller ticket sizes attract younger and global investors. The average investment size frequently falls below $1,000, thereby broadening the market.

Commercial buildings are the main focus of high-value real estate tokenization projects. Due to their stable cash flows, office buildings, logistics hubs, and retail centers are increasingly being tokenized.

Commercial tokenized assets usually have lower volatility and higher institutional participation. The data shows that more than 60% of enterprise-level tokenization projects are concentrated in commercial real estate.

Real estate development projects can be tokenized in order to attract capital during the very early stages of construction. Developers who use tokenized models to raise funds report that the funding cycle is from 15–30% faster than with traditional private equity structures.

One of the most convincing signals that supports the tokenization of real estate is the participation of institutions.

While institutions are entering the market, the need for enterprise-grade real estate tokenization platforms, as well as advanced development services, is growing.

One of the main factors leading to the success of real estate tokenization projects is compliance with regulations. Statistics reveal that more than 80% of failed tokenization projects have a regulatory compliance or jurisdictional limitation issue that accounts for their failure, rather than technology issues.

Platforms that succeed use programmable compliance, such as:

There are twice as many launches of pilot projects in regulatory jurisdictions with sandboxes, which emphasizes the necessity of adaptable compliance frameworks for the tokenization of real estate solutions.

Firms engaging in blockchain development and turning these metrics into their strengths get a tangible lead over other businesses in real estate tokenization development projects.

The real estate tokenization model incorporates innovative, continuous, and data-rich reporting methods.

Records kept on-chain provide the possibility for:

Research shows that the rate of investor disputes in tokenized real estate platforms drops by more than 50%, mainly because of the transparency and easy access to verifiable data.

The real estate tokenization introduces new risk profiles, besides offering efficiency.

Some of the main risk factors are:

The advanced real estate tokenization innovations layer security, legal mapping, and strong governance features to lessen these risks.

Real estate tokenization development has, from a business point of view, a major positive effect on the revenue flow of a company over quite a long period.

Blockchain firms such as full-stack tokenization partners gain higher deal size and retention than mere smart contract providers.

Reviewing the future, experts foresee:

When these tendencies are fully developed, platforms for real estate tokenization will be at the core of the digital capital markets infrastructure.

Real estate tokenization is no longer just a conceptual innovation but a data-backed transformation. Market figures confirm an accelerating uptake, enlarging deal sizes, and increasing institutional trust in tokenized property structures.

The features of a sophisticated platform for real estate tokenization must be the combination of a scalable blockchain architecture, a compliance intelligence system, and an investor-friendly design. The main factor in determining success in the tokenization of real estate is the existence of advanced real estate tokenization development capabilities.

For blockchain development firms that provide RWA solutions, this industry is one of the most attractive long-term prospects in the digital asset economy—mainly driven by quantifiable efficiency gains, market demand, and trillions of dollars in addressable value.

Enter your email → Get instant download.