Ethena’s artificial stablecoin USDe, has seen its total value locked drastically dropped in half, from $14.8 billion in October to $7.6 billion, despite the onchain usage continuing to grow. This more than 50% decrease is indicative of the fast dismantling of the accounts that were highly leveraged in decentralized finance markets, mainly on lending platforms like Aave. The coin USDe has kept a stable volume of transactions and user activity; however, the TVL growth that was driven by leverage has very much reversed sharply with the yield tightening.

USDe is aimed at keeping its value through a delta-neutral strategy that involves crypto spot collateral paired with short perpetual futures positions thus enabling the protocol to be the net receiver of funding-rate differentials. These funding payments make up the USDe yield that currently stands at around 5.1% per annum. In the earlier part of the year, perpetual market rates were double-digit which made it very attractive for leveraged strategies to carry out and thus significantly increase the stablecoin’s nominal value. As perpetual rates became lower due to weaker market demand for leverage, the returns on USDe have dropped substantially.

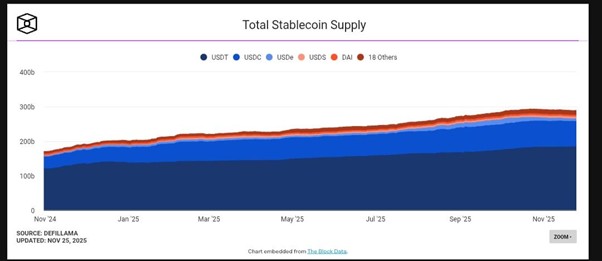

Source: Defilama

The decrease in yield has been one of the main reasons that have led to the disengagement of the heavily leveraged looping strategies that were most likely to have gone exponential in DeFi. On a platform like Aave, traders would deposit staked USDe (sUSDe), borrow USDC at high loan-to-value ratios, exchange the borrowed funds into sUSDe, and repeat the cycle several times. Leverage levels were so high (10x or more) that even a slight change in the cost of borrowing or the yield spread could make the difference between profit and loss.

When USDe’s APY went below that of the cost of borrowing (5.4% of USDC on Aave), the very reason for these positions to exist disappeared. Traders started to rapidly unwind their positions; this was a process by which they removed collateral, repaid loans and exited loops, hence, the speed of TVL contraction getting accelerated. The identical mechanics that led to TVL inflation during periods of high yields are in operation to reverse, thus the fast deleveraging cycle is happening due to the interaction event of automated liquidations and risk-off behavior.

While TVL has significantly reduced, onchain data shows that USDe is still the go-to currency for transactions, payments, and DeFi interactions. More than $50 billion in onchain transaction volume was recorded last month, showing persistent utility even as speculative leverage diminished. The discrepancy between TVL and usage is a reflection of the difference between real transactional demand and capital that is just sitting there for leveraged yield strategies.

USDe’s model is very much dependent on the dynamics of the funding-rate in perpetual futures markets, which makes it very sensitive to market conditions even when user utility is still there. The collapse in funding on most of the major exchanges has been one of the main reasons for the reduction in the available APY for USDe holders, thus the weakening of the incentives for the high-risk carry trades.

The deleveraging process has been accompanied by a general sentiment of a less yield-farming model approach in the DeFi space. A number of protocols that provide structured stablecoin yield opportunities had problems with sustainability or have started to shut down their programs. As these platforms scaled back operations, capital that had flowed into USDe through multi-protocol loops began to exit, magnifying outflows across the ecosystem.

The incident is a reminder that yield-bearing stablecoins are still quite fragile and can experience sudden capital flight if leveraged strategies happen to be unwinding at the same time.

Stay in sync with the fast-changing crypto landscape. Chainbull delivers expert commentary, insightful breakdowns, and the latest developments.

Enter your email → Get instant download.