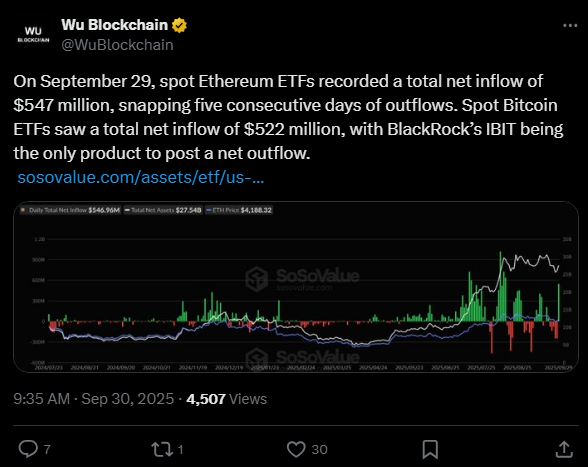

On September 29, the Spot Ethereum ETFs and Spot Bitcoin ETFs experienced major inflows, which led to sharp reversals of their respective trends from the previous days, when they had seen outflows. According to market data, a net inflow of $547 million was recorded in Spot Ethereum ETFs, ending a streak of five consecutive losses. Meanwhile, Spot Bitcoin ETFs achieved net inflows of $522 million. Still, the session’s only product that went from IBIT and where a net outflow was registered stood out was BlackRock’s iShares Bitcoin Trust (IBIT).

Source: Wu Blockchain

Over the past week, Ethereum ETFs have been losing continuously due to withdrawals, which reflected the overall cautious sentiment in the market as a result of macroeconomic uncertainties. The strong inflows on Monday, however, is a signal to us that there is a renewed interest from institutional investors in Ethereum.

On the day of these inflows, Ethereum’s price also bounced back and crossed the $2,700 mark, which could have been the reason for the inflows, as mentioned by the analysts. They suggest that the price recovery might have triggered the inflow,s as both hedge funds and retail investors may have used these regulated ETF products to get their long exposures.

In comparison to Ethereum, there were inflows in the majority of Bitcoin funds that indicated the stability of the institutional demand for the largest crypto asset in the world. The total net inflows of $522 million happened even though IBIT, the largest fund in the industry, had a small amount of outflows.

Other issuers, such as Fidelity and Ark 21Shares, also enjoyed a lot of investors, and as a result, Bitcoin ETFs got the support that they needed to remain on the plus side. The price for Bitcoin was almost $63,500, and it was going up with strong trading volumes and a high level of institutional interest.

The blended inflows into Ether and Bitcoin ETFs have been a prominent sign of the increasing role of officially sanctioned crypto investment vehicles in the delivery of the FATF connection between traditional finance and the digital asset field. The experts believe that the renewed demand for crypto ETFs can be a consequence of the expectations of a Q4 monetary policy loosening and the optimistic sentiment about Ethereum’s upcoming network upgrades.

Investors switching from outflows to solid net inflows reflect that they are still confident in the long-term prospects of Ethereum (ETH) and Bitcoin (BTC) as well as that ETFs will keep playing a pivotal role in the adoption by the mainstream.

Leading into October, the crypto market developments will be under the scrutiny of market watchers who will be assessing whether this inflow trend is enduring, and thus, they can be speculating on the possibility of new price rallies for both assets.

Enter your email → Get instant download.