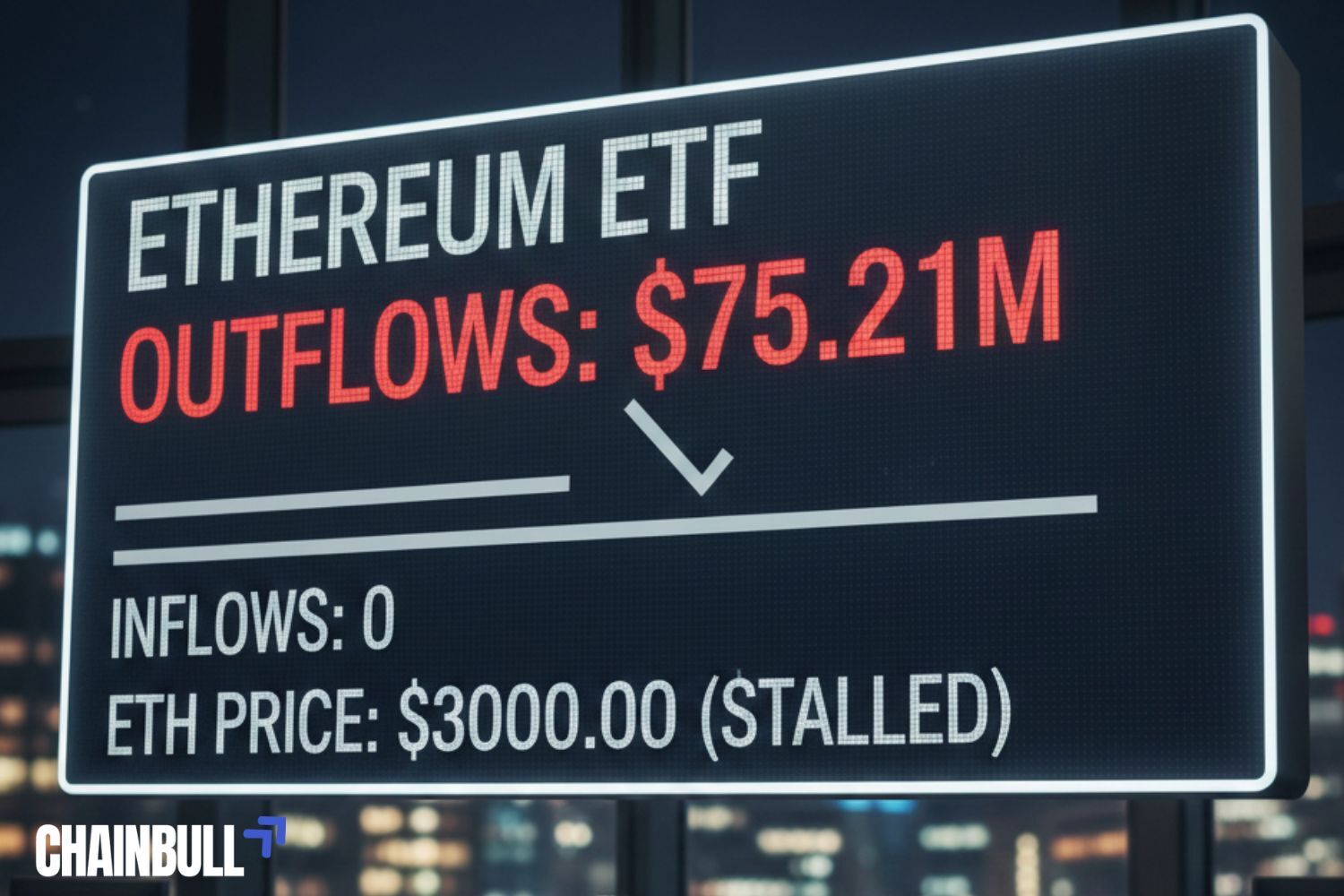

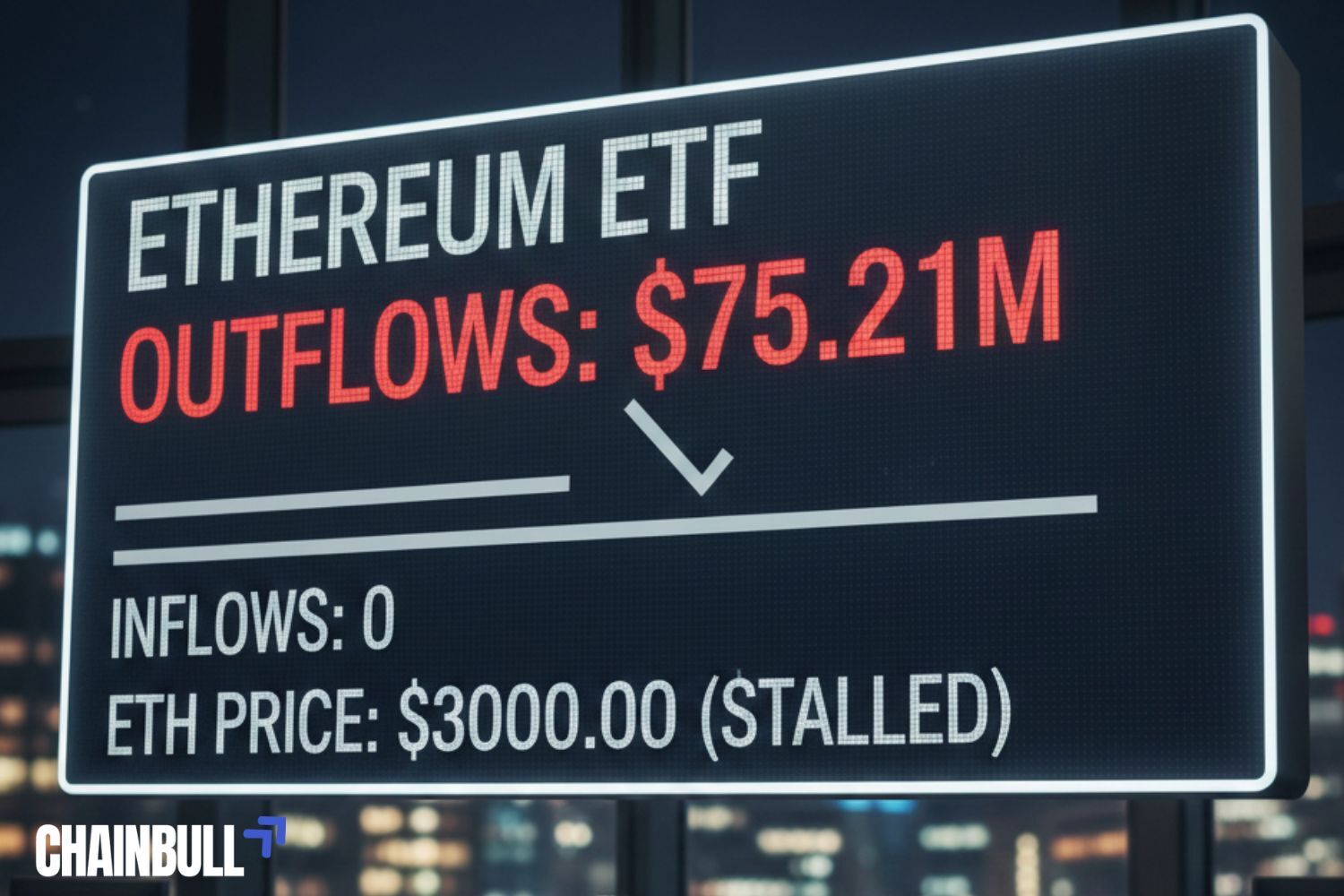

Ethereum ETFs just saw one of their toughest trading days in weeks, logging $75.21 million in outflows with no inflows at all. The sharp imbalance comes as ETH struggles to hold the crucial $3,000 level, signaling cooling investor appetite and rising caution across institutional desks.

Analysts say the complete absence of inflows is notable, especially given that ETH ETFs had recently shown signs of stabilizing. The latest data suggests institutions are hesitating to increase exposure while ETH remains stuck in a tight consolidation range. With macro uncertainty and weakening risk sentiment, many investors appear to be reducing positions rather than betting on a breakout.

At the same time, traders highlight that ETF outflows often intensify when price fails to gain momentum. Ethereum’s inability to reclaim higher levels has fueled defensive positioning, contributing further to the liquidity drain in spot ETF products.

Market strategists believe the outflow trend may not last if Ethereum reclaims support above $3,100–$3,200. Historically, ETH ETF flows tend to recover quickly when volatility stabilizes and clear trend direction returns. Some analysts argue that long-term fundamentals — including staking demand, Layer-2 expansion, and rising on-chain activity — remain intact despite short-term investor hesitation.

Still, until ETH breaks decisively away from $3K, ETF flows are likely to remain fragile. With zero inflows and heavy outflows marking the day, the market is signaling a wait-and-see stance, leaving Ethereum at a key inflection point for the weeks ahead.

Crypto evolves every second—make sure you don’t miss a beat. Visit Chainbull for expert insights, detailed market breakdowns, and trusted updates from the world of blockchain and digital assets.