Chainbull specializes in real estate tokenization development that transforms traditional property investments into digital blockchain assets. We build secure, scalable tokenization platforms for property owners, real estate developers, and institutional investors seeking fractional ownership solutions.

Real estate tokenization converts physical properties into digital tokens on blockchain networks, enabling fractional ownership, increased liquidity, 24/7 trading capabilities, and transparent transaction records. This technology opens real estate investment opportunities to a broader range of investors while reducing barriers to entry.

The benefits of real estate tokenization include global accessibility, enhanced liquidity, and tamper-proof transparency. By converting properties into blockchain tokens, owners can attract diverse investors and unlock new revenue streams.

At Chainbull, we provide end-to-end real estate tokenization solutions tailored to your project needs.Our comprehensive services include token development, strategic planning, legal compliance, platform deployment, and much more — ensuring a secure and seamless tokenization experience from start to finish.

Every successful real estate tokenization project starts with a clear strategy. At Chainbull, we offer expert consulting services to help property owners, developers, and investment firms evaluate the feasibility of tokenizing their assets. Our team also assists in building a strong legal and regulatory foundation, designing an effective go-to-market strategy, and ensuring compliance with jurisdictional requirements. From legal frameworks to investor onboarding, we guide you through every step to make your tokenization venture compliant, scalable, and profitable.

At Chainbull, we develop custom tokenized real estate platforms that are secure, scalable, and high-performing. Our experts build platforms on leading blockchain networks such as Polygon, Solana, SUI, Hyperledger, SPDX cooperative private blockchain, and Ethereum, depending on your project’s specific needs. These tokenization platforms are designed to handle a growing number of investors and transactions efficiently, offering optimized gas fees, fast transaction speeds, and long-term scalability.

At Chainbull, our blockchain developers have deep expertise in international security regulations. We build Security Tokens (STOs) that fully comply with global legal standards, ensuring transparency and investor protection.Our team customizes tokens using protocols such as ERC-20, ERC-1400, or custom token architectures that support fractional ownership and legal recognition. These security tokens include built-in compliance features like investor allowlisting, restricted transfers, and automated reporting, giving investors greater trust, security, and peace of mind.

Regulatory compliance is at the foundation of a successful tokenization platform. We build platforms that have regulatory compliance as the highest priority and integrate protocols. It is the accreditation of investors and reporting mechanisms. We also provide white-label real estate tokenization platforms with pre-built modules of compliance to those who desire quick go-lives. These solutions provide minimum time-to-market while ensuring that the platform remains compliant with SEC, FINMA, ESMA, MAS, and other jurisdiction-specific regulations.

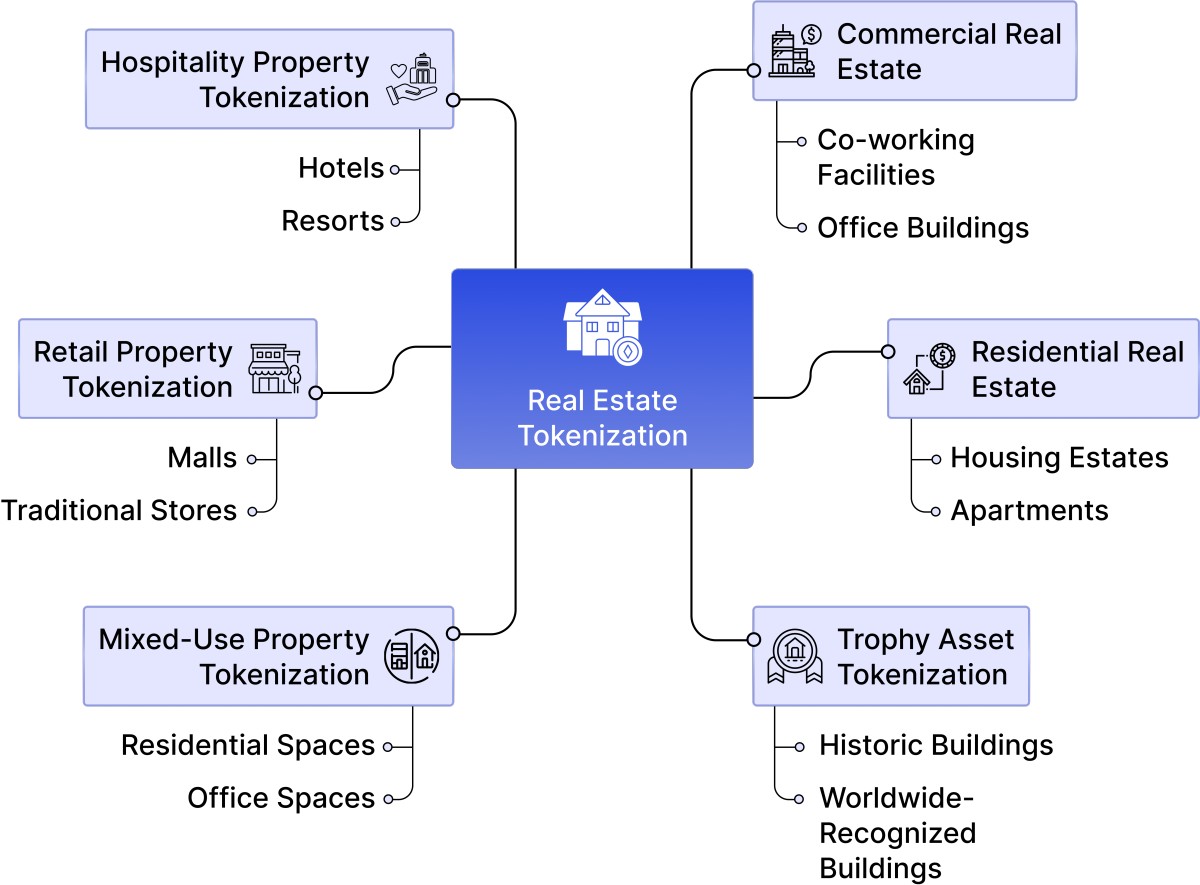

Our real estate tokenization solutions can be tailored for a wide range of property types. We help unlock liquidity and accessibility by enabling fractional ownership across residential buildings, commercial spaces, warehouses, luxury hotels, and REIT portfolios.By tokenizing diverse real estate assets, projects can attract global investors and spread risk across multiple property sectors — creating a more stable and decentralized investment ecosystem.

Every real estate project is unique — and so are our token design solutions. At Chainbull, we create custom tokenomics models aligned with your company’s goals. Whether you need equity tokens that represent ownership shares, debt tokens tied to revenue streams, or hybrid tokens that combine both, our experts design them with precision and compliance in mind.This ensures your tokens attract investors, deliver long-term value, and maintain regulatory compatibility across markets.

Smart contracts form the backbone of automated, transparent, and secure tokenized assets. At Chainbull, we develop highly secure and efficient smart contracts that handle dividend distribution, rental income disbursement, investor onboarding, and transaction security with precision. Our auditing team conducts independent code reviews and comprehensive security audits to eliminate vulnerabilities and ensure flawless performance. This gives both issuers and investors complete confidence in transparent, tamper-proof, and trustworthy transactions.

One of the key benefits of real estate tokenization is the easy and automated distribution of income. At Chainbull, our platforms include rent and dividend management systems powered by blockchain-based smart contracts. These systems automatically distribute rental income, dividends, and capital gains to investors — instantly, transparently, and without manual intervention. We also provide real-time reporting and transaction history, allowing investors to track their earnings seamlessly. This transparency builds trust, confidence, and stronger participation among all stakeholders.

Tokenization doesn’t just create new assets — it transforms existing properties into digital, tradable tokens. At Chainbull, we offer blockchain integration solutions that connect tokenized real estate with both traditional and digital financial platforms. Our solutions enable digital wallets that handle crypto and fiat transactions, support secondary market trading, and provide cross-chain compatibility. With these integrations, your platform operates seamlessly across decentralized and traditional financial ecosystems, delivering flexibility, accessibility, and efficiency to investors.

Start Your Real Estate Tokenization Journey Today! –

At Chainbull, we offer custom real estate tokenization solutions. We focus on scalability, security, and investor trust for tokenized real estate platforms.

We always use secure blockchain architecture and ensure transparency for transparent transactions and immutable records. We built a real estate tokenization platform on Ethereum, Polygon, Solana, or private chains. Our expert developers use institutional-grade security, which gives benefits to investors and issuers to boost confidence at the time of digital transactions.

Our real estate tokenization platform is always in adherence with KYC/AML. It makes onboarding smooth and meets global regulations. We integrate compliance modules that help in streamlining investor verification and accreditation. It ensures that each transaction is legally sound, so it reduces fraud and money laundering.

We provide real estate tokenization with multiple integrations. There are in-platforms and exchange integrations that allow smooth token liquidity through both internal platforms and external exchanges. With this, investors can quickly buy, sell, and trade real estate-backed tokens at any time.

Our real estate tokenization is integrated with smart contract automation. It helps token holders receive dividends and rental income. This process enhances investor trust and reduces operational inefficiencies.

Our tokenize platform has offered multi-currency support, so it accepts payments in fiat and crypto. Accept payments in both crypto and fiat. It also supports Bitcoin, stablecoins, and traditional fiat. This makes the process flexible, which attracts various investors worldwide.

We also provide an analytical dashboard that helps you track investments, ROI, and property performance. You can also get the real-time data from the intuitive dashboard, rental yields, and portfolio growth. These factors help investors to make fact-based decisions and also review health assets.

There are no geographical barriers on our platform that open the doors for global investors. It becomes easier for investors from the various zones to quickly participate securely with local compliance options.

Our tokenized real estate platform has integrated with DeFi protocols. It helps to expand liquidity for real estate tokens. Many investors can quickly lend, borrow, or stake against their assets. It also unlocks new revenue opportunities.

We are a top-notch real estate tokenization development company, so we have the expertise to convert various forms of property into blockchain tokens. These are the real estate forms that we have the tokenization expertise for:

At Chainbull, we specialize in commercial real estate tokenization, covering assets like co-working spaces, office buildings, malls, and more. These high-value properties, usually limited to large institutions, become accessible to a wider range of investors through our platforms. Our tokenized real estate solutions enable investors to own fractions of commercial properties, creating liquidity and expanding investment opportunities. Both investors and property owners benefit from shared rental income streams that operate independently of traditional banking systems, ensuring efficiency and transparency.

Residential properties, including housing estates, apartments, and condominiums, are highly suitable for real estate tokenization. Tokenization attracts retail investors by offering stable income streams and lower entry barriers to the expanding residential market. Many property developers divide ownership into digital tokens, enabling faster access to capital while allowing investors to participate with smaller amounts. Rental income is automatically distributed via blockchain-based smart contracts, ensuring transparency, security, and integrity in every transaction.

At Chainbull, we offer real estate tokenization solutions for trophy assets, including historic landmarks and globally recognized buildings. Traditionally accessible only to high-net-worth individuals, these limited assets can now be fractionalized through tokenization, allowing investors worldwide to own a share of luxury properties. This approach ensures transparent, secure, and accessible investment opportunities while preserving the long-term value of the properties.

Mixed-use developments combine residential, office, retail, and commercial spaces within a single project. Tokenizing these properties allows investors to gain exposure to multiple revenue streams, reducing risk and enhancing potential profitability. With blockchain-powered transparency, investors can track income from different sections of the development in real time. As a result, mixed-use property tokenization has become one of the most globally participated sectors in real estate investment.

Retail properties such as malls, high-street stores, and traditional shops offer strong income potential but often require substantial upfront investment. Through tokenization, fractional ownership makes these properties accessible to smaller investors, allowing participation in the retail real estate market. Rental income is automatically distributed to investors via blockchain-based smart contracts, ensuring timely and transparent payouts. Additionally, secondary market trading provides liquidity for token holders, a feature rarely available in traditional retail property investments.

Hotels, resorts, and other hospitality assets are ideal candidates for real estate tokenization due to their promising and diverse revenue streams. Tokenization allows investors to participate in revenues from bookings, events, and hospitality services, turning them into active stakeholders. It also offers fast fundraising, improved liquidity, and incentives for foreign investors, benefiting both developers and operators. Additionally, tokenization enables innovative ownership models, such as shared profits per stay or revenue-per-room schemes, providing flexibility and transparency for all parties involved.

Warehouses, production facilities, and logistics centers form the backbone of modern economies. Tokenization of warehousing and industrial properties gives investors access to a liquid, fast-growing asset class driven by global supply chain and e-commerce demand. Token holders can earn steady rental income, while developers gain quicker access to capital and liquidity, creating a mutually beneficial ecosystem.

Vacation rentals and short-stay properties in popular tourism destinations have become highly attractive to foreign investors. Through real estate tokenization, investors can now own fractions of holiday homes or property portfolios and receive rental income via platforms like Airbnb or Booking.com.This approach allows investors to diversify their portfolios with tourism-based real estate, while developers and property owners gain greater capital flexibility and expanded market access.

Luxury real estate assets, including private islands, villas, select resorts, and penthouses, have also embraced real estate tokenization. By fractionalizing high-value properties, tokenization allows a broader pool of investors to participate without compromising exclusivity. Tokenholders gain access to property appreciation and revenue streams, while developers benefit from faster fundraising and enhanced liquidity.

A real estate tokenization platform simplifies the entire tokenization process, providing investors with a smooth and seamless investment journey. It handles all aspects, from investor onboarding and regulatory compliance to trading, dividend distribution, and portfolio management.

Whether you are a property owner looking to raise capital or an investor aiming to diversify your portfolio, a real estate tokenization platform helps you manage everything in one place. Choosing the right platform ensures that your investments are secure, efficient, and profitable.

Before the introduction of RWA tokenization, owning real estate required massive capital and long-term commitments. But now RWA’s fractional real estate investing is making it possible for small and mid-sized investors to invest in real estate without the burden of full ownership.

Our customized solutions are best for both small projects and large real estate portfolios. We help in not only tokenizing a single residential building but also the commercial portfolio, we’ve got the tools and expertise to ease your tokenization journey. We also design custom dashboards through DApps Development for seamless property investment management.

We provide one of the most comprehensive Real Estate Tokenization Development Solutions in the market today which combines tech, compliance, and financial strategy into one integrated offering. We have simplified the process to tokenize real estate into six very easy steps:

Our expert team will conduct an in-depth research with due diligence to assess your asset value and the market potential.

We will handle the complex legal framework and ensure that the asset is compliant with tokenization laws.

We will develop these smart contracts, which are written to represent fractional ownership rights.

We will issue tokens that are tied to the property’s value and are ready for distribution.

We will verify users via KYC/AML checks to ensure that only authorized investors participate in buying.

Investors can trade their tokens through our secure secondary trading ecosystem.

| Feature / Capability | Chainbull | Tokenizer.Estate | RealT | Lofty AI |

|---|---|---|---|---|

| Global compliance support | Limited | Limited | ||

| Smart contract audits | No | No | ||

| Investor onboarding automation | Partial | Partial | ||

| Real-time analytics & dashboard | No | Basic | ||

| Fractional ownership support | ||||

| Private market & enterprise use | Optional | No | No | |

| Custom token standards (ERC-20 / ERC-3643 / ERC-1400) | Limited | No | No | |

| White-label & custom deployment | Limited | No | No | |

| Blockchain network flexibility | Limited | No | No |

Chainbull provides a level of industry experience and solutions for legal challenges to your real estate tokenization journey. We do not offer an ordinary tool but a future-ready digital solution for real estate ownership and investment.

They can tokenize upcoming projects and sell fractional units to fund construction early.

Offer clients more dynamic, low-barrier real estate investment products.

Build diversified property portfolios without being tied down to single assets.

Introduce alternative investment products to clients.

If you are ready to convert your physical assets into digital opportunities, it’s time to explore Real Estate Tokenization Development Services with Chainbull. Our platform is designed for performance and scalability, making it ideal for today’s forward-thinking property owners, developers, and investors.

Enter your email → Get instant download.