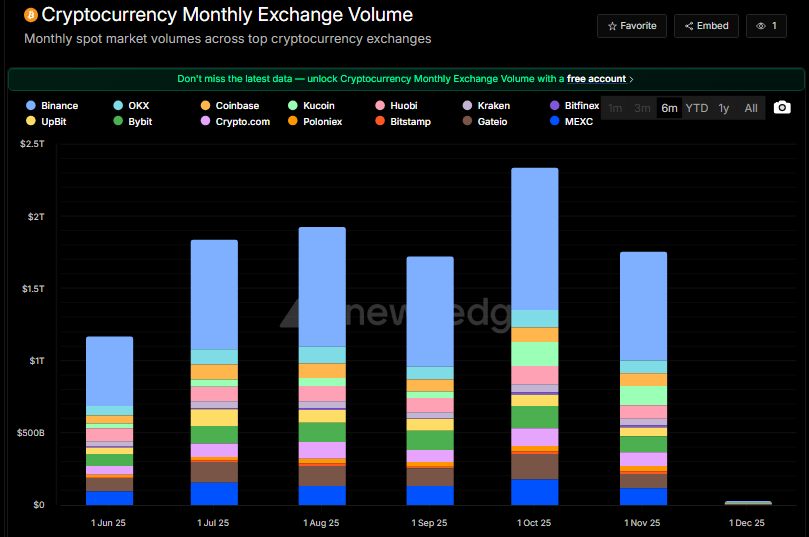

In November, a sharp decrease was witnessed in the spot trading activity of crypto exchanges. The monthly total volume dropped to $1.59 trillion, which is the lowest level since June. The decline represents a 26.7% slide from October’s $2.17 trillion, as the market conditions have changed around the digital asset landscape, and volatility has reduced. To explain this slowdown, industry analysts mentioned that the main reasons behind it are the low speculative behavior and fading of momentum, which they say led the traders to take a break after the previous months that were quite active.

Source: Newhedge

Centralized Exchange Activity SlumpsCentralized exchanges saw a broad decline in November as they suffered a big fall across the board. Linux-powered exchanges retained their positions as the largest trading venues around the globe, yet they also experienced a substantial decrease from their prior performance. In fact, Binance’s spot volume was down to $599.34 billion in November, whereas it was $810.44 billion in October.

This trend was also visible in the Bybit, Gate.io, and Coinbase platforms. Bybit traded $105.8 billion worth of crypto to be the second-largest venue, followed by Gate.io and Coinbase with $96.75 billion and $93.41 billion, respectively. The data shows a profound decrease that almost all platforms, regardless of their size or market focus, during the period in question.

Vincent Liu, CIO of Kronos Research, expressed his opinion that the drop in activity in November was anticipating the shift after October’s period of very active price movement. According to him, the decrease in spot trading on centralized exchanges was caused by traders moving from a “frenzy to flatness” state, as volatility was disappearing and market conditions were getting tighter. He also mentioned that the majority of the volume reduction was due to profit taking on the way down and trading momentum becoming subdued, a trend that he often sees after strong rallies when participants unwind their positions and liquidity temporarily dries up.

Decentralized exchanges also reflected a similar decrease in trading activities, thus, the reduction in DEX volumes was the main reason for the overall drop in trading activities of both on-chain and off-chain markets. DEX volume dropped to $397.78 billion in November from $568.43 billion in October, as per the data by DefiLlama.

This was the lowest volume level for the decentralized venues since last June, and the top platforms were showing deep decreases. Uniswap continued to be the biggest DEX with a volume of $79.98 billion, which is a decrease from $123.88 billion in the previous month. In contrast, PancakeSwap recorded $70.57 billion, which is a drop from $102.02 billion, and this is a clear indication of a comprehensive reduction in both liquidity and participation.

The ratio of DEX volume to CEX volume declined from 17.56% in October to 15.73%, thus, it was a sign of market behavior changing in such a way that traders preferred centralized venues over decentralized ones. Liu pointed out that the ratio’s drop was mainly due to changes in the structure rather than market sentiment.

Liu emphasized that the trading ranges becoming tighter in November was a reason why decentralized exchanges wouldn’t be able to attract more trading volumes as they do in times of high volatility, but on the contrary, centralized ones will be the winners because they can offer their traders deep liquidity and narrow spreads, resulting in more efficient and faster execution of their trades. Moreover, the decrease in DeFi incentives and fewer speculative transactions led to a lower level of activity on DEX platforms, thus slowing their turnover.

The major slump in the crypto market also harmed the overall activity of the exchanges, as the price of Bitcoin dropped from a level close to $110,000 at the beginning of November to around $81,000 on November 21. According to the data provided by the pricing platform, the value of Bitcoin as of late Sunday was $86,500, having decreased by 4.6% in the last 24 hours.

The change in the path of Bitcoin has also been the reason behind the change of fate of the institutional products, where the U.S. spot Bitcoin ETFs have been the most affected, as they experienced $3.48 billion worth of net outflows in November. This movement was contrary to the one in October, where $3.42 billion worth of net inflows were recorded, and therefore, this has been the major monthly outflow since February, hence the main cause of the overall downturn in trading volume across the ecosystem.

Crypto evolves every second—make sure you don’t miss a beat. Visit Chainbull for expert insights, detailed market breakdowns, and trusted updates from the world of blockchain and digital assets.

Enter your email → Get instant download.