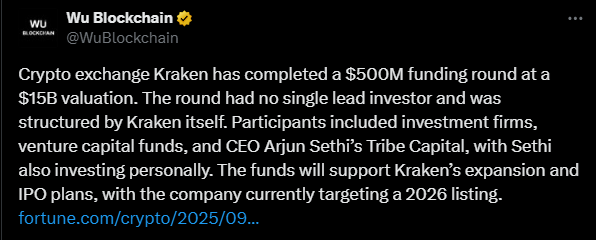

According to Fortune, the cryptocurrency exchange located in the U.S., Kraken, has secretly raised a $500 million financing round with a valuation of $15 billion. The funding, which went along with money from investment managers, venture capitalists, Tribe Capital, and co-CEO Arjun Sethi’s personal contribution, makes Kraken more powerful on the lineup before its anticipated IPO in 2026.

Kraken is one of the first and most reputable exchanges in the crypto market and has been around since 2011. While Coinbase, the rival, has been in the retail trading spotlight, Kraken has been quietly grabbing institutional and professional clients. This latest financing is a big step for the company, which has traditionally been very sparing with its venture capital, having raised only $27 million before this year.

Co-CEO Arjun Sethi, previously the co-founder of venture capital firm Tribe Capital, has been the main decision-maker at Kraken. Sethi, who is characterized by his data-driven management style and an idea of combining traditional finance with blockchain, has brought on board deals like a $1.5 billion acquisition of NinjaTrader, which in turn brought 2 million new customers.

Moreover, Kraken is transforming its retail business by xStocks—blockchain-based tokenized shares of companies like Apple and Tesla—already popular in markets like South Africa. The step underlines as per Sethi’s conviction that tokenized assets will change the face of global finance as they will be cheaper and more accessible to everyone.

Though, financially speaking, things look quite good; for example, in the Q2 Kraken reported a revenue of $411 million and post-Ebitda earnings of almost $80 million, the company has opted to postpone its IPO until 2026 due to regulatory and operational difficulties. The change took place at the same time as a large turnover of executives, among which the exit of the CTO and COO is noteworthy.

Nevertheless, Sethi maintains that Kraken has a growth perspective in the long term by concentrating on liquidity, advanced trading tools, and the interest of institutional investors. With tokenization and DeFi as the pillars of their strategy, Kraken is calling for mending the gap between traditional finance and crypto on a large scale.

As the crypto IPO wave accelerates with Circle, Gemini, and Bullish, Kraken’s ability to execute its 2026 listing will be closely watched. If Sethi’s vision of financial convergence materializes, Kraken could emerge as a key player not just in crypto trading, but in the broader global financial ecosystem.

Enter your email → Get instant download.