PancakeSwap’s rise to the ranks of high-liquidity crypto exchanges did not happen by accident. On a speedy yet affordable blockchain, combined with aggressive product and token incentives, it became the first stop for traders seeking large pools, low slippage, and fast execution – particularly retail traders and those swapping new tokens. Those basics are very evident in the numbers (multi-billion TVL figures and billions of 24-hour volume), but the “why” is a blend of technology, incentives, and user experience.

With the main numbers behind, the way the PancakeSwap ecosystem is built encourages liquidity to flow where it is the most useful: in stablecoin pairs and popular token pools that are the base of heavy trading, arbitrage, and professional market makers. This mix of breadth and depth allows PancakeSwap to be strong in busy market windows – and, in particular, to be very enticing to the traders who are looking for the best DEX liquidity 2025.

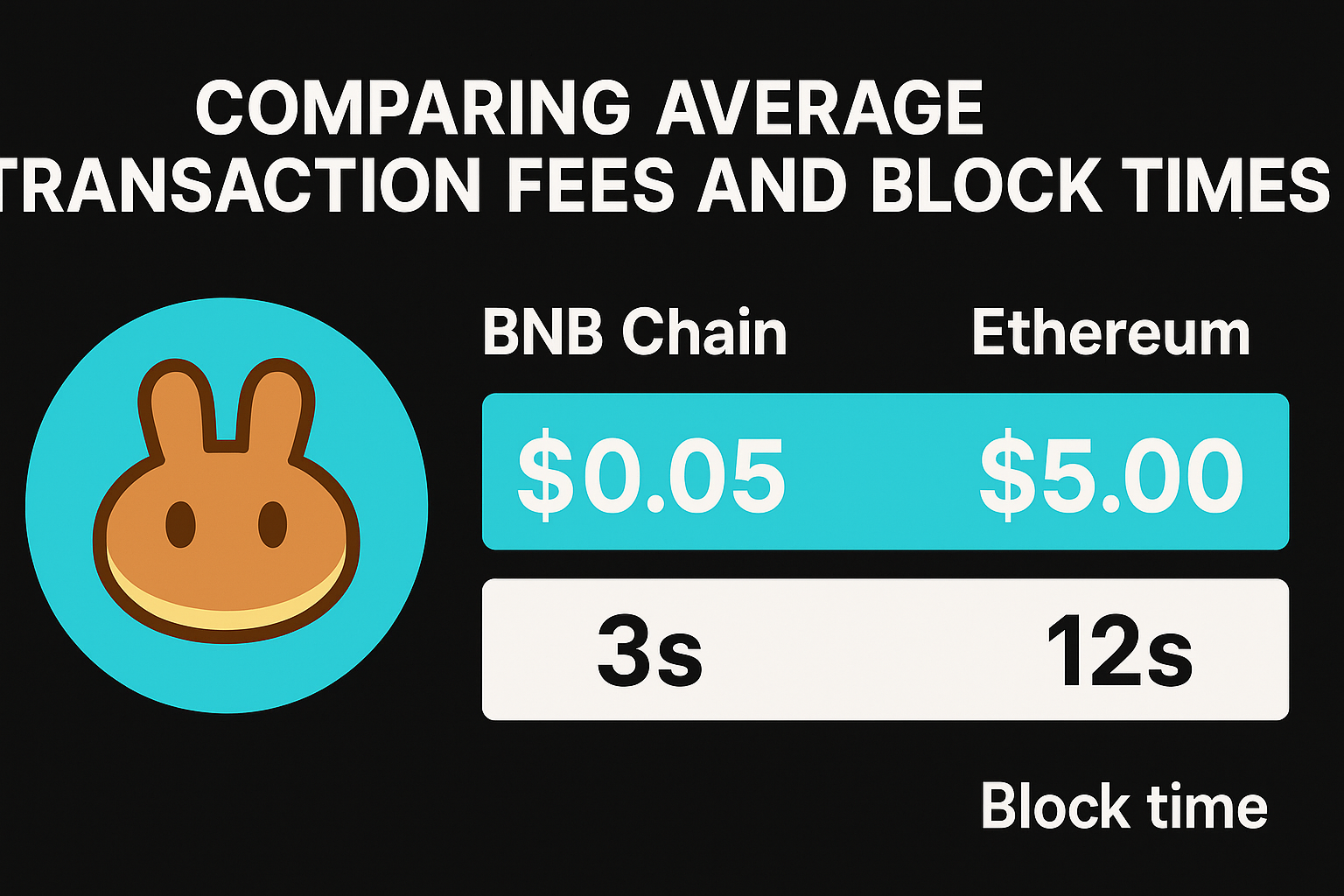

A major factor behind the deep liquidity of PancakeSwap is the economics of the underlying chain. Compared with many other Layer-1 chains, BNB Chain (formerly BSC) provides users with very low transaction fees as well as fast block times. When gas costs are minimal and the number of confirmations is small, traders are free to do multiple trades, arbitrate the price differences, and jump from one pool to another without the fear of being priced out. For the users that trade in smaller amounts, i.e., meme coin speculators, DeFi yield chasers, and retail swap users, the low friction trading means more trading frequency and higher aggregate volume, which then would lead to the deepening of liquidity.

Cheap and fast trades also contribute to the lowering of the effective slippage for the depth of a particular pool. So, a pool with $10M of TVL on PancakeSwap can in many cases provide an equal execution quality to a pool with much larger size on a higher fee chain if the fees are taken into account – a practical cost advantage that keeps coming back customers who are casual traders and arbitrage bots.

PancakeSwap mints a plethora of BEP-20 pairs, ranging from major stablecoin pairs (USDT/USDC) to newly born memecoins and high-cap tokens. In fact, stablecoin-to-stablecoin pools are considered liquidity anchors: these attract money that searches for the least impermanent loss, support large-volume swaps, and serve as the plumbing for arbitrage across chains. Such stable pools are the funds that market makers and liquidity aggregators place because execution risk and volatility are lowered.

Diversity matters: when liquidity has been distributed among different pairs (and concentrated where demand is highest), the protocol is able to service a wide variety of trades without fragmenting the depth of the pool. This concentrated diversity is in fact the one feature which defines as on-chain liquidity of the highest quality.

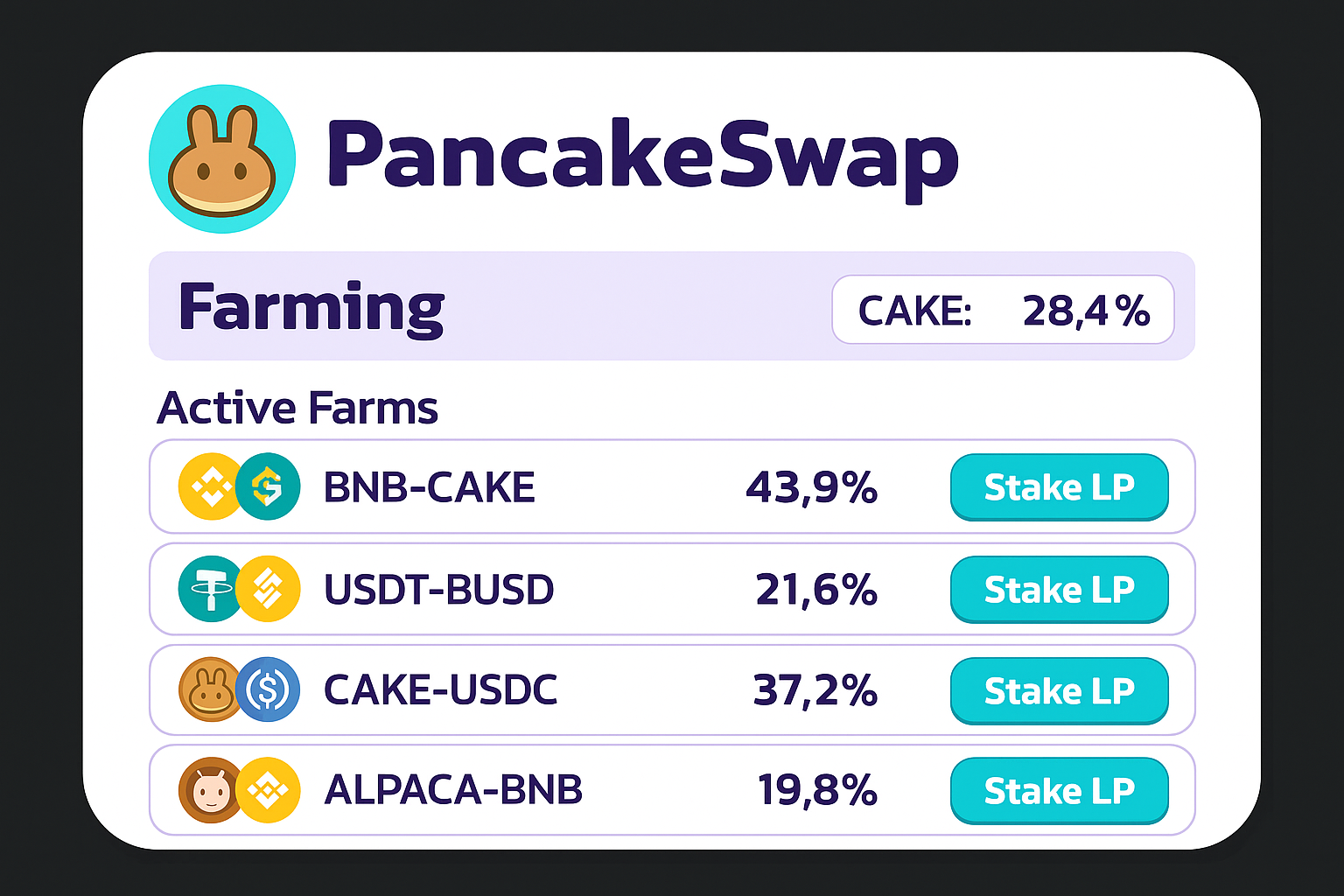

The use of tokens as incentives is still one of the main ways to attract and retain liquidity. The native token of PancakeSwap, CAKE, is the power that runs syrup pools, staking, and yield farms which reward liquidity providers. Time-limited campaigns — yield boosts, airdrops, and trading competitions — bring fresh capital into pools and re-activate dormant LP tokens. Over repeated cycles, those incentive programs yield not only temporary inflows but also longer-term habit formation: users who begin providing liquidity for APY often leave capital allocated once the pools show reliable activity.

The resulting effect: well-designed token incentives make it cheaper for the protocol to acquire liquidity and thus, pool depth is sustained, which in turn allows high trading volumes.

The PancakeSwap forked off from a rudimentary AMM swap to an ecosystem with multi-products: concentrated liquidity (V3-style features), derivatives and perpetuals, NFT marketplaces, launchpads, lotteries, and gamified experiences. These products have various users in common — traders, collectors, project teams, and retail speculators — and each of them bring liquidity in different ways (LP tokens, collateral, margin capital).

Just to be more specific, the derivatives and perpetuals offered, in particular, can lure bigger traders and market makers, and as a result, more order flow will be available. This, in turn, will increase turnover and attract arbitrage strategies that tighten spreads and increase effective depth across pools.

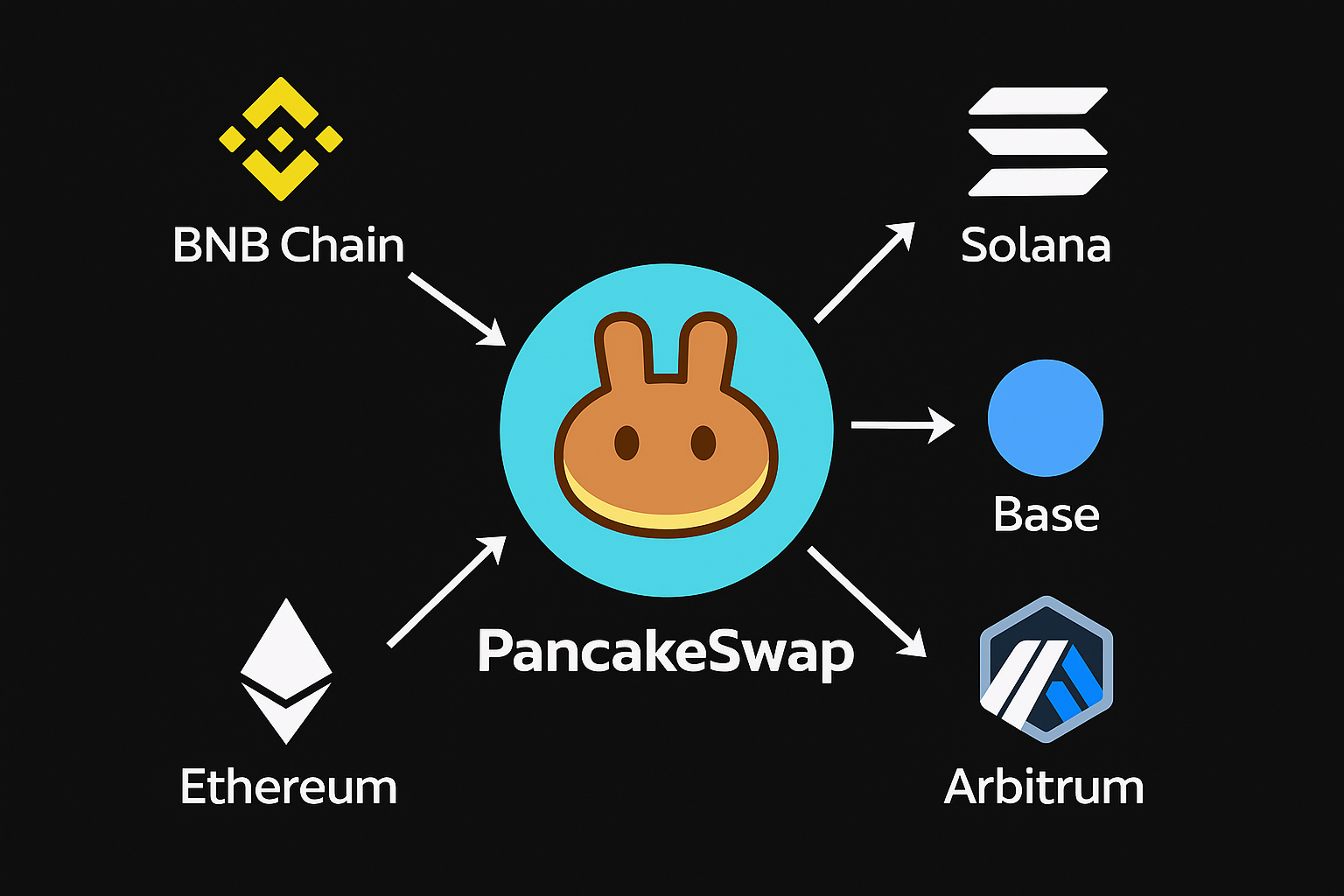

Despite always being a BNB Chain-based project, the ongoing cross-chain expansion of PancakeSwap is allowing for liquidity to come from several different ecosystems. Through bridges and multi-chain deployments, tokens from Solana, Base, Arbitrum, and even Ethereum can be represented and traded via PancakeSwap pools. Cross-chain inflows diversify the capital base and increase the number of arbitrage opportunities that tie separate markets together — reinforcing the AMM’s role as a liquidity hub rather than a silo.

On top of that, the multi-chain coverage allows tokens to be listed in front of a wide, cross-border userbase, which makes teams more likely to incentivize liquidity directly on PancakeSwap.

Ease of entry is a small detail with large effects. PancakeSwap works smoothly with popular wallets like Trust Wallet, Binance Wallet, and MetaMask (on BNB Chain), and benefits from Binance ecosystem synergies for on-ramps and user education. Lower onboarding friction means more users — especially newcomers — can swap or add liquidity with minimal setup friction. That steady flow of new participants compounds over time, bringing incremental liquidity that adds up across dozens of pools.

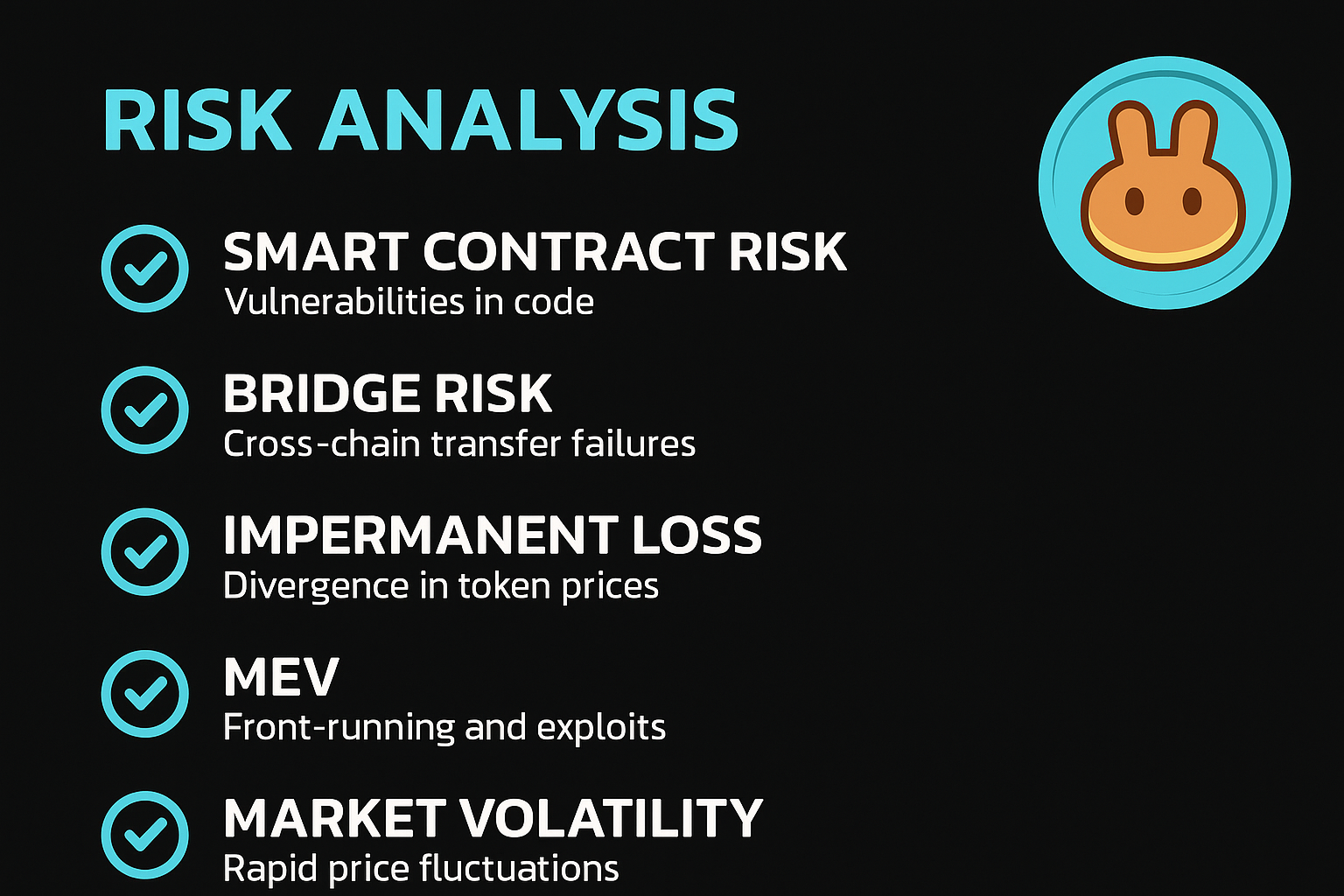

MEV protections, batch transactions, and better routing logic also reduce the fear of sandwich attacks and failed transactions, which further encourages both retail and pro users to use the platform.

High liquidity attracts professional traders. Market makers prefer venues where they can post sizable quotes with limited slippage; arbitrageurs seek venues where price differentials can be profitably exploited after transaction costs. PancakeSwap’s combination of deep pools and low fees is an invitation for both.

Once professional actors engage consistently, their activity reduces spreads and stabilizes prices, which improves execution for everyone and makes the exchange more attractive. This feedback loop — liquidity attracts volume, which attracts market makers, which further improves liquidity — is one reason PancakeSwap continues to show top DEX volumes.

Compared to many Ethereum-based DEXes, PancakeSwap’s lower operating cost for traders is a decisive advantage for small and medium trades. High fees on Ethereum push many traders to multi-chain or layer-2 alternatives; PancakeSwap benefits directly when those traders prioritize cost. Additionally, the platform’s focus on memecoins and new token launches captures a high-frequency segment of the market that naturally generates large volumes and churn.

The dominance of PancakeSwap in the liquidity space is a result of aligned incentives, low-cost execution, broad product coverage, and cross-chain expansion. The low trading fees on the BNB Chain make the platform easily accessible to day traders; the availability of stable pools and the burning of CAKE tokens as incentives attract and retain liquidity; the variety of products available attracts different types of investors; and market makers and arbitrageurs complement each other in their liquidity. The result is a self-reinforcing ecosystem where volume and depth feed each other — giving PancakeSwap a sustainable edge among decentralized venues in 2025.

Enter your email → Get instant download.