Exodus Movement, a provider of a self-custody crypto wallet, has planned an acquisition of W3C Corp, along with its subsidiaries Baanx and Monavate, for a total consideration of $175 million. The deal represents a strategic shift of the New York-listed company to the next level. The company aims to combine crypto-to-fiat payments under a single ecosystem. The acquisition is estimated to be completed in 2026, pending approval from various authorities.

The companies commented on the acquisition, which practically integrates the infrastructure with Exodus, where with a single click, the user can directly spend his digital assets. The users can transact digital assets with traditional payment rails. This simply means that protocol tokens such as USDC or USDT can be used directly with payment cards. By doing this, Exodus achieves being more than a simple asset storage platform capable of asset management, where end consumers will have a usable payment experience through major networks and issuing partners.

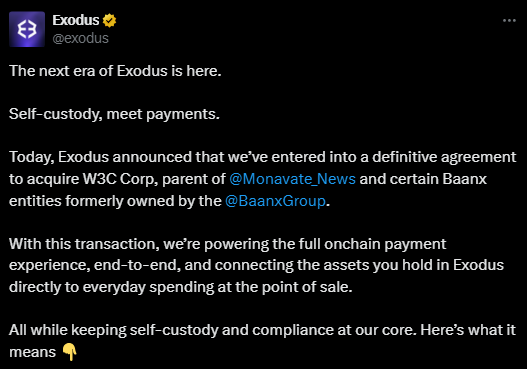

Source: Exodus

According to Exodus, the acquisition will allow them to perform the issuance of crypto-linked payment cards through well-established networks that include Visa, Mastercard, and Discover. The integration of the W3C’s subsidiaries Baanx and Monavate with Exodus enables a single integrated system to handle compliance, processing, issuing, and settlement more efficiently. This move extends the enterprise’s geographic operational capabilities in the United States, the United Kingdom, and the European Union.

JP Richardson, CEO, and co-founder, said the elimination of barriers between holding crypto and spending it is the long-term focus of the company. He remarked that already millions of users entrust Exodus with the safekeeping of their stablecoins and other digital assets and that there is a logic in the platform’s existing functionality to internalize the payments infrastructure. Richardson further explained that the merger would transform Exodus into a platform that many users will no longer need to look elsewhere for storing, managing, and spending money across both traditional and digital rails.

Exodus plans to support the acquisition with a mix of their current cash on hand and by a bitcoin-backed credit facility from Galaxy Digital, as per the announcement. The firm revealed that it has issued a loan of nearly $58.8 million to W3C and may give an additional $10 million to aid operational liquidity before the closing of the acquisition.

The company highlighted that the financial structure is designed to provide both short-term flexibility and long-term planning for integration. The use of bitcoin as a collateral to obtain financing is one of the many ways digital assets are becoming part of treasury and corporate operations strategies in the crypto sector.

The accord with W3C is a continuation of Exodus’s Latin America expansion journey, which began with the acquisition of Grateful, a stablecoin payments startup based in Uruguay. That deal was intended to expand the wallet provider’s presence across Latin America and accelerate the adoption of crypto-based payments. The new W3C acquisition aligns with that expansion strategy by enabling broader global support through licensed payment infrastructure and card-issuing frameworks.

After the news was made public, Exodus shares were trading higher by 3.62% and closing at $15.18 on the New York Stock Exchange. Nonetheless, the stock has been on a downward trend as it is down by 40.3% over the last month and has lost 56.6% in the past six months, according to The Chainbull’s price page.

Crypto evolves every second—make sure you don’t miss a beat. Visit Chainbull for expert insights, detailed market breakdowns, and trusted updates from the world of blockchain and digital assets.

Enter your email → Get instant download.